Introduction

Are you a tax professional looking to grow your practice with streamlined solutions? White label tax business software could be exactly what you need. Designed to enhance efficiency, personalize your services, and offer more value to clients, white label solutions are revolutionizing the tax service industry. But what exactly is white label tax business software, and why are so many tax firms turning to it?

This guide will break down everything you need to know about white label tax software: from its features and benefits to choosing the right solution and using it to maximize your business potential.

Understanding White Label Tax Software

What “White Label” Means in the Software Industry

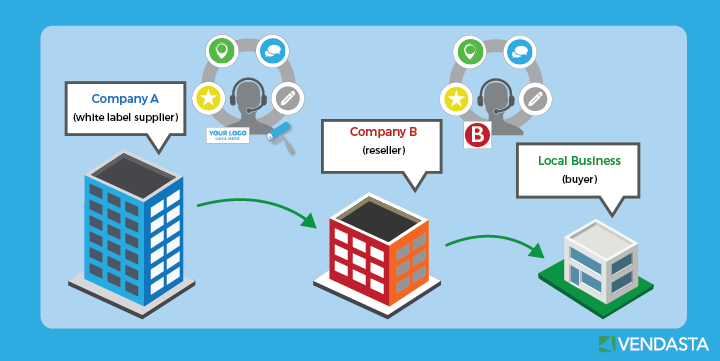

In software, “white label” refers to products created by one company but rebranded and sold by another. For tax businesses, this means using software that can be customized with your own branding, giving clients the impression that the tools are developed in-house.

How White Label Software Benefits Tax Firms

White label tax software is a powerful asset. By adopting these customizable tools, firms can appear larger and more established while offering professional-grade software at a fraction of the cost of custom development.

Key Features of White Label Tax Software

Custom Branding Options

White label solutions let you add your logo, colors, and branding to the software, allowing a consistent look and feel that strengthens your brand identity.

Secure Data Management

Top white label tax software uses secure data storage and encryption to protect sensitive client data, meeting strict industry standards.

Automation of Tax Processes

From document uploads to e-filing, white label software often includes automation features that simplify tax preparation and filing.

User-Friendly Interfaces for Clients

Many white label tax solutions come with easy-to-navigate portals for clients, enhancing their experience with simple, straightforward tax management.

Advantages of Using White Label Software for Tax Services

Cost-Effectiveness and Revenue Potential

Instead of investing in costly development, tax firms can leverage white label software to offer high-quality services at a lower price, opening up more revenue opportunities.

Enhanced Customer Trust Through Branding

A consistent brand presence builds trust. When clients see your name and logo on the software they use, it fosters a sense of credibility and professionalism.

Time-Saving Automation Features

With automation, tasks that once took hours can now be completed in minutes, freeing you up for more critical work.

Better Customer Support Options

Top providers offer dedicated support and resources, ensuring you and your team get the most out of the software.

How White Label Tax Software Works

Step-by-Step Process of Integration

Integrating white label tax software typically involves:

- Signing up with a provider

- Configuring the software with your branding

- Training your staff on the system

- Launching the software to your clients

Training and Support for Easy Implementation

Leading software providers offer comprehensive training and support, so your team can quickly adapt to the new system.

Choosing the Right White Label Tax Software Provider

Important Features to Look For

When choosing a provider, prioritize security, ease of use, customization options, and responsive customer support.

Comparing Top White Label Providers

Researching providers ensures you find the right fit for your firm. Look for reviews, demos, and feature comparisons to make an informed decision.

Questions to Ask Potential Vendors

Consider asking:

- What is the onboarding process like?

- How customizable is the software?

- Are there any hidden fees?

White Label Tax Software for Small Businesses and Startups

How Small Firms Can Compete with Big Players

White label software levels the playing field, allowing small firms to offer the same sophisticated tools as larger tax companies.

Affordable White Label Options for New Tax Professionals

Many providers offer scalable pricing, making white label solutions accessible for new or growing businesses.

Understanding Pricing Models in White Label Tax Software

Subscription-Based Models

A common model where firms pay a monthly or annual fee for access to the software, ideal for firms with steady, recurring client bases.

Pay-per-Use Models

Perfect for firms with seasonal clients, pay-per-use models charge only for actual software usage, providing flexibility.

Hybrid Pricing Options

Some providers offer hybrid models, combining subscription fees with usage-based billing for greater customization.

Customizing the Software for Your Brand

Logo and Color Scheme Customization

Simple branding options like color schemes and logos make your white label software feel unique to your firm.

Personalized Client Portals

Custom client portals provide clients with an exclusive, branded experience that reinforces your firm’s professionalism.

Custom Reporting Options

Offer reports that match your firm’s layout, giving a consistent presentation to clients.

Ensuring Security and Compliance

Data Encryption and Secure Access

Data security is paramount. White label tax software uses encryption and secure access protocols to protect sensitive information.

Compliance with Tax Regulations and Standards

Good white label software is designed to meet regulatory standards, ensuring your practice stays compliant.

Protecting Client Information

Confidentiality is key in tax services, and white label solutions are built with security in mind to safeguard client data.

Common Challenges and How to Overcome Them

Training Employees on New Software

Training is crucial for seamless adoption. Providers often offer tutorials and support materials to help your team get comfortable.

Managing Client Expectations

With new tools come new expectations. Communication and training can help clients feel confident using the new system.

Staying Updated with Software Features

Software providers frequently update features, so keeping up with these changes can help you use the software to its fullest potential.

Case Studies: Success Stories of White Label Tax Software

How Firms Improved Efficiency

Many tax firms report that white label software has helped them cut down on administrative time, allowing more focus on client service.

Real-World Examples of Revenue Growth

By using white label software, firms can take on more clients and offer premium services, ultimately boosting revenue.

Future Trends in White Label Tax Business Software

AI and Machine Learning in Tax Automation

AI integration is on the rise, and soon tax software may offer intelligent automation, reducing manual work even further.

Increased Focus on Data Security

With growing cyber threats, data security will continue to be a top priority in tax software.

Rising Demand for Customization

As tax firms seek unique branding, the demand for customization will shape future software offerings.

Tips for Maximizing White Label Software in Your Tax Business

Best Practices for User Adoption

To get the most out of your software, make sure your team is comfortable using it, and encourage feedback for improvement.

Leveraging Analytics for Client Insights

Use analytics tools within the software to gain insights into client needs and improve your services.

Conclusion

White label tax software is changing the tax industry. By offering branded, professional-grade tools, tax firms can improve efficiency, client satisfaction, and overall success. Whether you’re a new tax professional or an established firm, white label software offers unique advantages that can set you apart from the competition.